Chicago Public Schools’ finances, like districts across the country, have been impacted by the COVID-19 pandemic. The FY2022 revenue budget reflects the unanticipated and historic changes to revenue sources that are the result of the COVID-19 pandemic. As a unit of local government, CPS’ sources of revenue are categorized by the level of government (local, state, and federal) that collects, distributes, or grants resources to the district––all of which have been impacted by the pandemic.

The largest share of local revenue comes from the Chicago Board of Education’s ability to tax residents on the value of their property. The stability of this revenue source is vital to the financial health and viability of the district. Property taxes are the most general and unrestricted funds allocated to CPS schools and departments. CPS’ ability to extend taxes is governed by PTELL, or the Property Tax Extension Limitation Law, which limits the amount CPS can increase its property tax levy by the lesser of the change in the Consumer Price Index (CPI) or 5 percent. The County Assessor’s office responded to the pandemic’s impact on the job and housing market by instituting an automatic reduction, also referred to as the COVID Adjustment, in the value of property and subsequent tax bills owed. The lack of growth in the base value of property means that CPS will see property tax revenue gains lower than in previous years.

The largest portion of state funding is allocated to CPS and other Illinois districts through Evidence-Based Funding, or EBF. The EBF model allocates additional funding through a tiering system that directs new investments in state education funding to districts most in need of resources. At the end of the recent state legislative session, the General Assembly passed a state budget that includes a $362.1 million increase to EBF funding, despite an earlier recommendation in the Governor’s budget proposal, later reversed, to keep EBF funding flat to FY2021 levels. As an under-resourced district, CPS will see additional state funding in FY2022, and due to the EBF distribution construct, the additional amount will become the base for CPS’ appropriation in FY2023.

The federal government’s response to the pandemic through the passage of ESSER I, II, and III has allocated a historic level of federal funding to CPS. 1 The one-time revenue has been budgeted to support Moving Forward Together––the district’s plan to combat the effects of the pandemic on student achievement and well-being––and offset lost revenue and increased costs resulting from the pandemic. The federal aid packages have resulted in allocations totaling $2.8 billion over five fiscal years beginning in FY2020. Without this financial relief, it would not have been possible to manage the costs incurred from meeting the technological needs of remote instruction and ensuring school buildings are equipped to welcome back students and educators safely.

Along with this one-time relief, President Biden’s FY2022 budget request for the Department of Education increases Title I by $20 billion and Individuals with Disabilities Education Act (IDEA) funding by $2.6 billion. 2 While the final appropriations will depend on congressional action, the prospect and need for an increase to structural federal revenue should not go unmentioned.

The following section details the factors, assumptions, and trends that are the basis of the FY2022 revenue budget.

| FY2021 Budget | FY2021 Projected End of Year | FY2022 Budget | FY2022 vs. FY2021 Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,264.9 | $3,232.7 | $3,374.2 | $109.3 |

| Replacement Tax | $194.9 | $281.9 | $234.9 | $40.0 |

| Other Local | $570.9 | $557.5 | $553.5 | ($17.4) |

| Total Local | $4,030.8 | $4,072.1 | $4,162.6 | $131.8 |

| State Revenues | ||||

| EBF | $1,665.8 | $1,657.8 | $1,705.8 | $40.0 |

| Capital | $47.3 | $14.1 | $23.3 | ($24.0) |

| Other State | $625.7 | $625.7 | $602.2 | ($23.4) |

| Total State | $2,338.7 | $2,297.6 | $2,331.3 | ($7.4) |

| Federal | $1,336.7 | 1,218.8 | $2,107.9 | $771.2 |

| Investment Income | $0.5 | $2.5 | $0.1 | ($0.4) |

| Reserves | $22.0 | $22.0 | $10.0 | ($12.0) |

| Total Revenue | $7,728.6 | $7,613.0 | $8,611.8 | $883.2 |

| FY2022 Total Budget | Amount for Debt Service | Amount for Capital | Balance for Operating Budget | |

|---|---|---|---|---|

| Local Revenues | ||||

| Property Tax | $3,374.2 | $51.1 | $5.0 | $3,318.1 |

| Replacement Tax | $234.9 | $39.4 | $0.0 | $195.5 |

| Other Local | $553.5 | $142.3 | $14.0 | $397.2 |

| Total Local | $4,162.6 | $232.8 | $19.0 | $3,910.8 |

| State Revenues | ||||

| EBF | $1,705.8 | $480.4 | $0.0 | $1,225.3 |

| Capital | $23.3 | $0.0 | $23.3 | $0.0 |

| Other State | $602.2 | $0.0 | $0.0 | $602.2 |

| Total State | $2,331.1 | $480.4 | $23.3 | $1,827.6 |

| Federal | $2,107.9 | $24.7 | $10.0 | $2,073.1 |

| Investment Income | $0.1 | $0.0 | $0.0 | $0.1 |

| Reserves | $10.0 | $0.0 | $0.0 | $10.0 |

| Total Revenue | $8,611.8 | $738.0 | $52.3 | $7,821.6 |

| FY2021 Operating Budget | FY2021 Estimated End of Year | Variance Estimated vs Budget | FY2022 Operating Budget | FY2022 vs. FY2021 Budget | |

|---|---|---|---|---|---|

| Property Tax | $3,204.0 | $3,171.8 | ($32.2) | $3,318.1 | $114.1 |

| Replacement Tax | $155.5 | $242.5 | $87.0 | $195.5 | $40.0 |

| TIF Surplus | $96.9 | $126.9 | $30.0 | $136.9 | $40.0 |

| All Other Local | $289.6 | $289.6 | - | $260.3 | ($29.3) |

| Total Local | $3,745.9 | $3,830.7 | $84.8 | $3,910.8 | $164.9 |

| State Aid | $1,578.9 | $1,570.8 | ($8.0) | $1,549.6 | ($29.3) |

| State Pension Support | $266.9 | $266.9 | - | $278.0 | $11.1 |

| Total State | $1,845.8 | $1,837.8 | ($8.0) | $1,827.6 | ($18.2) |

| Federal | $1,301.8 | $1,193.0 | ($108.8) | $2,073.1 | $771.3 |

| Investment Income | $0.5 | $0.5 | - | $0.1 | ($0.4) |

| Reserves | $22.0 | $22.0 | - | $10.0 | ($12.0) |

| Total Revenue | $6,916.0 | $6,884.0 | ($32.0) | $7,821.6 | $905.6 |

CPS is projected to receive $3,374.2 million in property tax revenues in FY2022, which remains the district’s largest single revenue source. Of the total property tax revenue, $56.1 million is revenue from the Capital Improvement Tax levy, which includes $51.1 dedicated to paying debt service on bonds issued for capital improvements and $5 million in additional levy receipts. Within the operating budget, CPS projects to receive $463.8 million from the dedicated Chicago Teacher Pension Fund (CTPF) levy, leaving $2,854.5 billion left for all other operating costs.

Of the $2,854.5 billion, $2,711.3 billion is from the CPS property tax education levy, $78.3 million is revenue from Transit Tax Increment Financing (TIF), and an anticipated additional $65 million is from proposed changes to the property tax code from Senate Bill 0508.

The FY2022 budget includes an increase to property taxes of $114 million from the FY2021 budget, $76.8 million of which comes from an increase in CPS’ education levy. To calculate the increase in revenue from the education levy, an estimate of the change to the previous year value of taxable property was made. In prior years, this information was publicly available through the Cook County tax agency report. At the time of writing, the final Equalized Assessed Value (EAV) for tax year 2020 is not available. Based on the assumed FY2021 final levy amounts and property values, the increase in the education levy includes roughly $38 million from increasing the education levy by the rate of inflation of 1.4 percent, and roughly $39 million from the $608.8 million in new property that is projected to be included in the 2021 tax bill and the $963.2 million in projected TIF district expiries.

In addition to the increases from the education levy, Senate Bill 0508 3 legislation passed by the General Assembly is (at the time of publication) awaiting the Governor’s signature and anticipated to provide CPS with approximately $65 million in property tax funding in FY2022. The legislation allows Illinois school districts to receive the amount of property tax levied but not received due to property tax bill refunds processed through the state treasurer’s office.

Offsetting the increase to CPS’ projected education levy revenue is a drop in projected revenue from CPS’ pension levy. Due to the impact of off-cycle property value reassessments, described below, CPS anticipates a $26.4 million decrease in projected pension levy collections. Transit TIF collections are projected to be down by just over $1 million dollars due to the anticipated decline in property value in the TIF district.

CPS’ property tax levy is subject to PTELL, or the Property Tax Extension Limitation Law. PTELL limits the amount government agencies, or in this case, school districts, can extend or collect from a taxing district. Each year, CPS levies property taxes to fund the operations of the public school system. The amount that CPS requests, through the Board of Education, cannot reflect an increase greater than the change in the Consumer Price Index (CPI) or 5 percent. Tying tax increases to CPI is intended to prevent taxpayers from being overburdened by government activity that is irrespective of larger economic trends and has subsequent impact to taxpayers.

The Illinois Department of Revenue is responsible for publishing the CPI that will be used for any government unit subject to PTELL. For the FY2022 property tax levy calculation, the CPI applied to the FY2021 extension is 1.4 percent 4 . This inflation rate is lower than the previous year’s rate of 2.3 percent. While a slowdown in CPI was anticipated because of the economic downturn associated with COVID-19, the 1.4 percent represents the lowest increase in inflation in the past five years.

The Cook County Assessor’s office reassess property values on a triennial cycle. The last cyclical reassessment for City of Chicago property values happened in tax year 2018. However, due to the impact of COVID-19 on the economy, Assessor Fritz Kaegi’s office performed an off-cycle evaluation for the City of Chicago in March and April 2020 to help ensure that property owners were not overly burned by tax bills during a period of high unemployment, downturns in the commercial market, and the stay at home mandates ordered by Governor Pritzker. This reassessment has led to reductions in assessed value in residential and commercial properties 5 . The FY2022 budget includes an estimated 6.8 percent drop in citywide EAV due to this reassessment, which has driven an overall decrease in pension levy receipts as described above.

The city will undergo its regular reassessment in 2021, though forecasting the impact of the reassessment is challenging not only because of the off-cycle COVD-19 reassessment but also because Assessor Kaegi’s office has publicly shared that assessments prior to Kaegi taking office have been historically inaccurate and were not equitably or fairly distributing the tax burden to different neighborhoods and communities throughout the County, specifically throughout Chicago. The FY2022 budget includes an estimated growth of 8 percent in citywide EAV due to the scheduled 2021 reassessment.

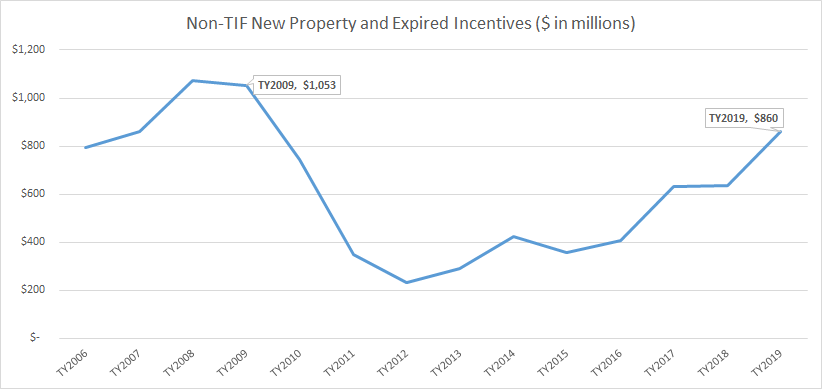

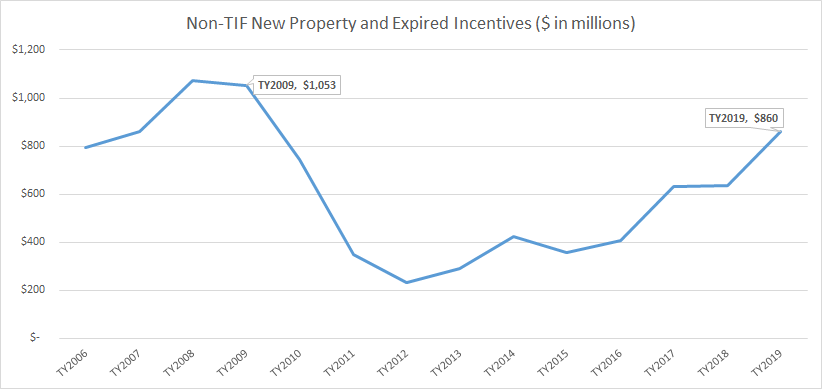

As explained earlier, CPS, under PTELL, is able to increase its property tax levy on existing taxable properties at the rate of inflation. Property that was either constructed during a given tax year, or newly taxable as part of the incremental value of an expired TIF district, is not included in the base property amount that the CPI is applied to each year. Both new property and the incremental equalized assessed value (EAV) of an expiring TIF district are taxed at the same rate as existing properties.

In tax year 2021, an anticipated amount of $608.8 million of newly constructed property and $963.2 million of incremental TIF EAV will be taxed and subsequently become part of the 2022 tax base.

Chart 1: Non-TIF New Property in Chicago, Tax Years 2006-2019 6

A smaller portion of CPS operating revenues is generated by the TIF district created for the Red-Purple Modernization Program (Transit TIF) on the North side of Chicago to modernize Chicago Transit Authority (CTA) tracks from North Avenue to Devon Avenue. By statute, CPS is due approximately 52 percent of all incremental value produced in the Transit TIF. In FY2022, CPS projects that Transit TIF revenues will be $78.3 million, representing a slight reduction of just over $1 million from the FY2021 revenue budget of $79.3 million. While 2021 is a reassessment year and will increase property tax collections in FY2022, the impact of the County Assessor's 2020 off-cycle reassessment means that 8 percent anticipated increase in FY2022 is bringing property values to a level nearly flat to the original FY2021 anticipated value.

Personal Property Property Replacement Taxes (PPRT) are collected by the state of Illinois and distributed to local governments state-wide. While the tax rates behind the collections are constant, the amount of funding CPS receives from this revenue can vary significantly from year to year. This is because PPRT is a tax that businesses and partnerships, trusts, and S corporations pay on their net Illinois income, along with a tax that public utilities pay on invested income. As corporate and investment income fluctuates, so does the amount received by local government agencies, including CPS.

The collection rates, found below, are greatest for the CIT and are therefore used to provide the basis of the CPS revenue budget.

Prior to the late 1970’s, local governments and school districts were statutorily allowed to levy taxes on business properties. After the General Assembly revoked that ability, legislation instituting PPRT was passed to mitigate the revenue loss to local taxing agencies. The portion of PPRT disbursed to Illinois local government agencies reflects the amount collected in tax year 1977. For CPS, the portion of collected PPRT distributed is 14 percent.

In FY2022, Personal Property Replacement Tax (PPRT) receipts are budgeted to increase by $40 million from FY2021. As discussed throughout this chapter, the FY2021 revenue budget was developed during a time of great economic uncertainty due to the impact of COVID-19 on employment, the housing market, and consumer spending. PPRT is outperforming the FY21 revenue budget, and this trend is anticipated to continue into FY2022. With debt service payments from PPRT remaining at their FY2021 level of $39.4 million, the operating budget for PPRT is $195.5 million for FY2022.

This increase reflects the state of Illinois Corporate Income Tax (CIT) estimates from the state’s Office of Budget and Management that anticipate year-over-year growth of 16.7 percent due in part to proposed changes to both federal and state tax code. 8 The growth is net the amount of CIT disbursed after diversions to the refund fund and the amount diverted by the Governor for the local government distributive fund. The refund fund deposit is a percentage established by the Illinois Department of Revenue to fund corporations' requests for refunds from CIT taxes collected.

CPS expects to receive $136.9 million in TIF surplus funding in FY2022, exceeding the $96.9 million budgeted in FY2021 by $40 million. In October 2020, the City of Chicago’s 2021 budget was approved and included a declaration of TIF surplus funding of a historic $304 million. 9

State law requires that surplus funds are proportionally distributed to the taxing bodies within the districts. The surplus declaration in the city’s FY2021 budget directs $176 million in TIF district property tax revenue to CPS, $70 million above the district’s original estimate of $96.9 million. However, because the City of Chicago and CPS fiscal years do not align, CPS anticipates $40 million of of $70 million to be utilized in CPS fiscal year 2022, growing the FY2021 CPS original budget amount of $96.9 million to $126.9 million and the providing an anticipated FY2022 surplus of $136.9 million.

“All other local” revenue includes the pension payment made by the City of Chicago on behalf of CPS for their employer contribution to the Municipal Employees’ Annuity and Benefit Fund (MEABF), which is estimated to be $115 million in FY2022. Though CPS recognizes revenue to reflect the portion of the expense covered by the city, FY2022 marks the third year that CPS is absorbing some of the pension costs of its non-teaching staff. Prior to FY2020, the City of Chicago paid CPS’ entire MEABF employer contribution, but CPS now bears $100 million of that cost to offset the city’s contribution on behalf of CPS employees.

FY2022 local capital revenue of $19 million assumes $4 million in TIF-related project reimbursements and $10 million from other local funding sources such as aldermanic menu funds, the Metropolitan Water Reclamation District, and $5 million from CIT property tax collections not tied to existing bond issuances.

In FY2022, CPS’ state revenue budget is $2,331.3 million, which comprises 27.1 percent of CPS’ total budget. As discussed above, the state provides funding to CPS through Evidence-Based Funding and several smaller appropriations that come in the form of reimbursable or block grants.