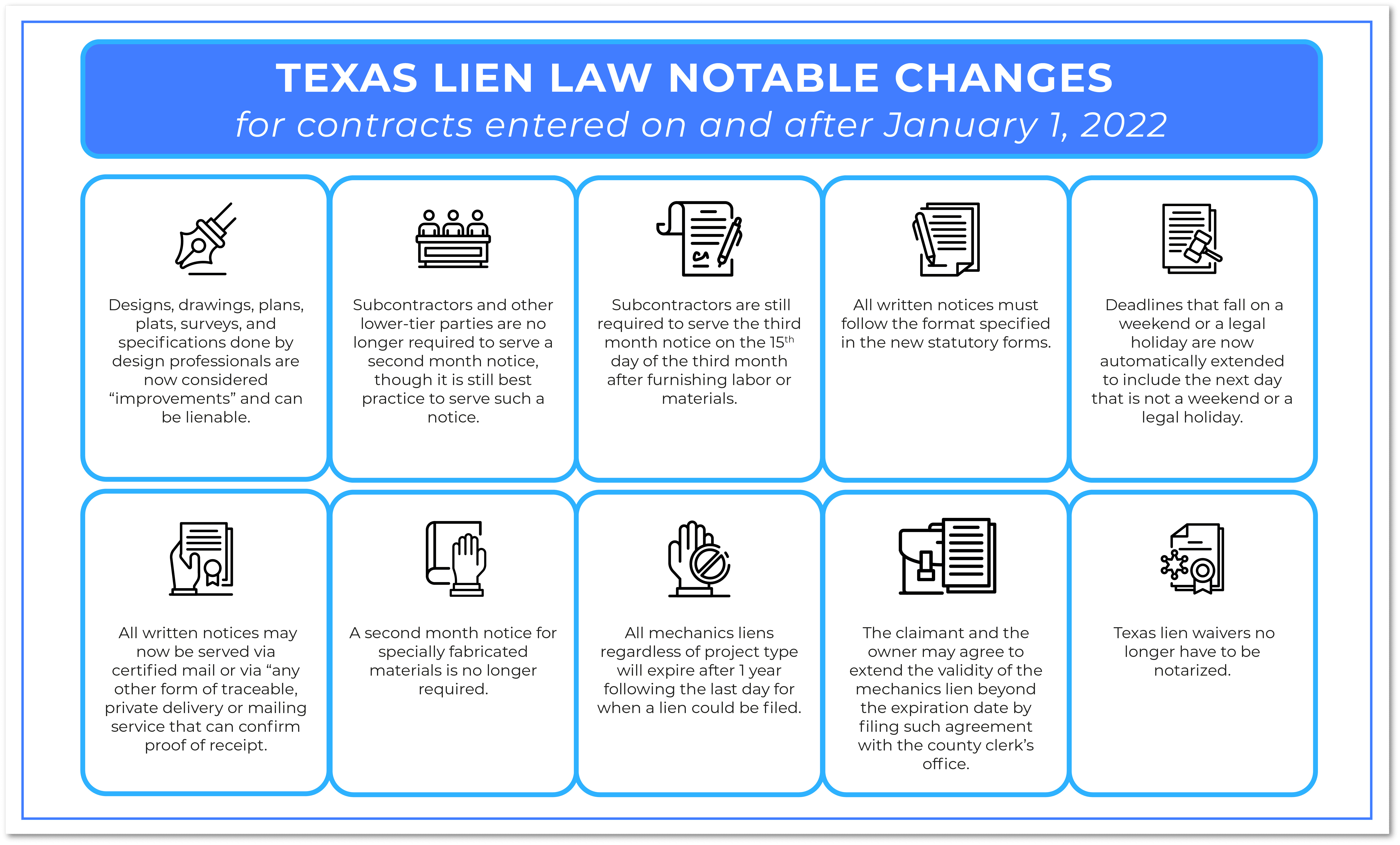

On June 15, 2021, Gov. Greg Abbott signed into law House Bill 2237, introducing major changes to Chapter 53 of the Texas Property Code 1 . These changes, which took effect on January 1, 2022, reflect new rules and regulations surrounding the filing of a Texas mechanics lien and all steps that come with it, including notice requirements and deadlines.

This guide summarizes the changes in Texas mechanics lien laws brought about by the passing of HB 2237.

The updated Texas lien law took effect on January 1, 2022.

It is important to note that the changes only apply to contracts executed on or after January 1, 2022. This means that if you have an ongoing project on or after January 1, 2022, but your contract was signed before this effective date, the old Texas lien laws will still apply in your situation.

All stakeholders of a construction project are affected by the updates to the Texas mechanics lien laws. These stakeholders include property owners, contractors, subcontractors, material suppliers, architects, designers, engineers, landscapers, etc.

The changes and updates to the Texas mechanics lien rules and requirements are summarized as follows:

an original contractor who can effectively control the owner or is effectively controlled by the owner through common ownership of voting stock or ownership interests, interlocking directorships, common management, or otherwise, or who was engaged by the owner for the construction or repair of improvements without a good faith intention of the parties that the purported original contractor was to perform under the contract. For purposes of this subdivision, the term “owner” does not include a person who has or claims a security interest only.

the real property and improvements for a single-family house, duplex, triplex, or quadruplex or a unit in a multiunit structure used for residential purposes in which title to the individual units is transferred to the owners under a condominium or cooperative system that is:(A) owned by one or more adult persons; and

(B) used or intended to be used as a dwelling by one of the owners.

“NOTICE OF CLAIM FOR UNPAID LABOR OR MATERIALSThe Notice of Claim for Unpaid Retainage must also be in the following format:

“WARNING: This notice is provided to preserve lien rights.

“Owner’s property may be subject to a lien if sufficient funds are not withheld from future payments to the original contractor to cover this debt.

“Date: _______________

“Project description and/or address: _______________

“Claimant’s name: _______________

“Type of labor or materials provided: _______________

“Original contractor’s name: _______________

“Party with whom claimant contracted if different from original contractor: _______________

“Claim amount: _______________

“_______________ (Claimant’s contact person)

“_______________ (Claimant’s address)”

“NOTICE OF CLAIM FOR UNPAID RETAINAGE

“WARNING: This notice is provided to preserve lien rights.

“Owner’s property may be subject to a lien if sufficient funds are not withheld from future payments to the original contractor to cover this debt.

“Date: ________________

“Project description and/or address: ________________

“Claimant’s name: ________________

“Type of labor or materials provided: ________________

“Original contractor’s name: ________________

“Party with whom claimant contracted if different from original contractor: ________________

“Total retainage unpaid: ________________

“________________ (Claimant’s contact person)

“________________ (Claimant’s address)”

Yes, you are still strongly encouraged to serve a Texas second month notice even if it is no longer a requirement. Keep in mind that serving notices have other benefits other than preserving your lien rights.

Serving a preliminary notice in Texas as well as in other states allows you to have open and consistent communication with higher-tier parties. It also lets you remain “visible” in a project, and it can help you get paid quicker. Consequently, serving second month notices will also help you reduce your day sales outstanding metric or DSO.

The days sales outstanding or DSO measures the average number of days that it takes you to collect payment from your clients. In other words, the DSO lets you measure how quickly you convert your invoices to cash.

By serving the second month notice, even if it is not technically required, you are more likely to receive payments for your invoices sooner than later. This improves your DSO and other key performance indicators.

Even if you do not receive payment, you will remain “visible” to the property owners and prime contractors when you consistently serve the notices. This is important, especially when you work on large-scale projects with numerous project participants.